Checking Accounts

Small Business Checking

Read More about Small Business Checking.Commercial Checking

Read More about Commercial Checking.Non-Profit Checking

Read More about Non-Profit Checking.- Free Online Banking with BillPay1

- Business CheckCard2 with Tap to Pay

- eStatement3 with Online Check Images or Paper Statement with Images

- 250 Items Included per Month ($.40 Per Item in Excess)

1 BillPay includes 10 free transactions per Access ID per month. Additional transactions are $.55 each.

2 Officer approval may be required. Foreign ATM fees may apply.

3 Small Business Checking customers are required to enroll in Online Banking and enroll in eStatements to receive monthly statements electronically.

- Free Online Banking with BillPay1

- Business CheckCard2 with Tap to Pay

- eStatement with Online Check Images or Paper Statement with Images

- Earnings Credit May Offset Monthly Service Fee

Per Item Charges:

- Checks Written/Debits $0.11

- Checks Deposited $0.06

- ACH Debits $0.25

1 BillPay includes 10 free transactions per Access ID per month. Additional transactions are $.55 each.

2 Officer approval may be required. Foreign ATM fees may apply.

- Free Online Banking with BillPay1

- Business CheckCard2 with Tap to Pay

- eStatement with Online Check Images or Paper Statement with Images

1 BillPay includes 10 free transactions per Access ID per month. Additional transactions are $.55 each.

2 Foreign ATM transaction fees may apply.

Savings Accounts

Business Money Market

Read More about Business Money Market.Business Savings

Read More about Business Savings.- Tiered Interest Rate

- Interest Credited Monthly

- Limited Check Writing

- Free Online Banking

- eStatement with Online Check Images or Paper Statement with Images

- Withdrawals are limited to six per month unless performed in person

- Earns Interest

- Interest Credited Monthly

- Withdrawals are limited to 6 per month unless performed in person.

Cash Management

Business Online Banking

Read More about Business Online Banking.Remote Deposit Capture

Read More about Remote Deposit Capture.Lockbox

Read More about Lockbox.Positive Pay

Read More about Positive Pay.Account & Statement Reconciliation

Read More about Account & Statement Reconciliation.Wire Transfers

Read More about Wire Transfers.Merchant Services

Read More about Merchant Services.Security

Read More about Security.Access your account information at your convenience, 24/7, to quickly and easily monitor your accounts and put yourself in control of your finances.

Business online banking is as simple as logging in to online banking once a separate Access ID and Passcode is established for your business accounts. Business online banking offers the basic functionality of online account access, and additional cash management tools can be set-up to your account as requested.

- Unlimited access to account history

- Download to your accounting and/or tax software program (i.e. Quicken/ Quickbooks)

- Transfer funds easily between your business checking/savings accounts

- Notify Me Account Alerts – receive emails and SMS text messages based on the account activity you specify:

- Existing balance on checking or savings

- Balance above or below a specific $ amount

- Check #(s) cleared

- Transaction greater than specified $ amount (great for fraud monitoring)

- Deposit posted to your account

- BillPay -- up to 24 months bill payment history, schedule recurring or one-time bill payments

- View/print online check & deposit images

- Reorder checks online

- Repurchase Agreement Tracking/Securities Collateralization Tracking

If you would like more information, please contact us. You can contact us via e-mail or use this website to find the First Security Bank nearest you.

A convenient way to capture electronic images of paper checks and transmit those images for deposit into your account.

Bank with ease – directly from your business

Accelerate access to your funds and improve staff productivity by converting your paper checks to electronic files – at your own place of business. Using a scanner we provide, deposit checks directly from your office

Remote Deposit Services save you time

No matter how big or small your business, our remote electronic deposit services can help you speed workflow, reduce expenses, improve cash flow, and eliminate trips to the bank

Reap the Benefits of Check 21 Legislation

Check 21 legislation lets you present check images to the bank, rather than physically transporting paper remittances. Check images are retained for up to 30 days. First Security has a range of practical tools to help you make the most of Check 21.

- Our remote deposit solutions give you these advantages:

- Check images uploaded via secure internet connections.

- Optimize deposit availability by converting eligible checks to electronic payments.

- Reduce paperwork associated with deposits.

- Speed reconciliation time with online notifications.

- Consolidate banking relationships.

- Improve your cash flow when checks clear in two days or less.

- Eliminate trips to the bank

Remote Deposit Process Flow

- Capture electronic check images

- Transmit these images for deposit into account

- Same day credit

- Email confirmation of deposit receipt

- Convenient, secure, time-saving

If you would like more information, please contact us. You can contact us via e-mail or use this website to find the First Security Bank nearest you.

Turn paper checks into available funds faster by allowing First Security to receive your payment checks on your behalf.

Accelerate Your Receivables Processing

With our secure lockbox site and innovative electronic receivables products, we can help you cut hours – or days – out of your collections process by automating your receivables posting.

Improve Deposit Availability

First Security’s Lockbox services deliver comprehensive, flexible remittance processing that can substantially streamline your accounts receivable function. In addition, our Lockbox services can help you to:

- Reduce day’s sales outstanding

- Improve staff productivity by automating manual processes

- Decrease the potential for theft, fraud and error by reducing the number of employee “touches” on each transaction

- Access decision-critical account information from your desktop

- Speed remittances – and improve overall cash flow

How Lockbox Works

At our secure lockbox site, we accept electronic and paper remittances from your customers, we can convert the checks to electronic payments, and then transmit the information directly to you.

Our time-saving service includes daily mail pickups. We can provide necessary data to update your accounts receivable system, and provide same-day information access via electronic reporting. Traditional paper reporting is also available.

How does it work?

- Your customer receives bill in the mail

- Customer submits payment to our PO Box

- FSB receives mail with payment

- FSB processes and images payments in bulk

- Customer account is debited $ payment amount

- $$s are deposited into your account – payments posted

- FSB transmits the payment file to you for viewing /reconciliation, or payment files can be viewed online.

If you would like more information, please contact us. You can contact us via e-mail or use this website to find the First Security Bank nearest you.

This check fraud prevention feature automatically compares details of checks issued by your business through your account at First Security, each business day.

- Scans for check fraud and/or errors on a daily basis when each check is presented by comparing check number, issue date, and check amount to the check issue file you provide to First Security Bank.

- Puts you in charge of paying or refusing items which do not match your issue information by requiring your approval of exceptions.

- Potential unauthorized activity is substantially reduced in the event of lost, stolen or fraudulent checks.

- Business online banking customers can view check exceptions presented for payment, prior to approval, via their online banking session from their office. Much greater efficiency in reviewing and approving exceptions.

If you would like more information, please contact us. You can contact us via e-mail or use this website to find the First Security Bank nearest you.

You can pay anyone, anytime - safely and efficiently. Make electronic payments to vendors, schedule cash disbursements and even pay individuals via direct deposit.

Eliminate paper check costs and problems

Let First Security’s Cash Management Service show you how to use our flexible desktop internet ACH service to initiate, verify, reverse, and delete transactions from our secure internet connection.

Cut expenses and reduce fraud risk

Simplify the way you transfer secure vendor payments, employee compensation, federal and state tax payments, and other transactions into recipients’ accounts

Choose Flexibility and Control

With electronic processing the funds move faster, the risk of errors and fraud drops, and you can maintain optimal cash control with fewer resources. Let us show you how to convert your paper based transactions to:

- Decrease processing costs

- Improve employee satisfaction by offering direct deposit of payroll

- Reduce exposure to check fraud by eliminating paper checks

- Leverage excess balances with account analysis

- 2FA (two factor authentication) security token authentication required for online access

If you would like more information, please contact us. You can contact us via e-mail or use this website to find the First Security Bank nearest you.

Account activity data customized to your needs will allow your business to reconcile transactions on multiple levels reducing the time spent on account management and audit functions.

- Receive a monthly reconciliation file of account items electronically

- Download your account history to popular software programs (Quickbooks, Peachtree)

- Provides concise and timely reporting on check activity and account history

- Customize how your account is reconciled:

- X9.37 file reconciliation

- BAI file reconciliation

- Electronic data storage provides access to your account activity anytime and reduces time spent on research while maximizing your record storing capacity.

If you would like more information, please contact us. You can contact us via e-mail or use this website to find the First Security Bank nearest you.

Quickly and securely move money to parties in the United States or in many foreign countries—in U.S. or foreign currency.

When you need to move funds quickly and reliably

- Electronic payment, brokerage purchase, drawdown, or other transaction where you need speed and verification, anywhere in the U.S, usually same day

- Real-time notification means you never have to worry about transaction status

- Quickly process same day and future dated domestic and foreign wire payments

- View wire reports on your schedule, customized to meet your needs, through our internet access portal

- You control authorized users and assign accepted transactions for security purposes

- Dual control allows you to approve or reject outgoing wires and monitor wire activity in your accounts

- 2FA (two factor authentication) security tokens are required to access this functionality for your security

If you would like more information, please contact us. You can contact us via e-mail or use this website to find the First Security Bank nearest you.

First Security Merchant Services offers your business reliable and cost effective credit card processing. Let us help you choose the card services your business needs so you can focus on sales and service, not on getting paid. And with First Security Merchant Services your personal banker is always a local phone call away.

- Your accounts are credited the next business day – ‘next business day settlement’

- All major credit cards accepted – VISA, MasterCard, American Express, Discover

- We offer competitive pricing on terminals and equipment

- We can meet any businesses need to accept credit card payments with Virtual Terminal service: online entry, over the phone, tablet or mobile device, for one-time or recurring payments.

- Secure payment transaction processing including EMV ‘Chip Card’ capable

- Online statement access and paper statements available

- 24/7 access to customer service and technical support

If you would like more information, please contact us. You can contact us via e-mail or use this website to find the First Security Bank nearest you.

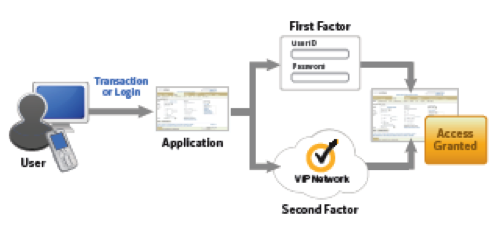

Two-Factor Authentication (2FA)

When First Security Bank Customers need to offer their employees access to Business Online Banking applications and Cash Management Tools in order to increase productivity and workflow, conducting these business transactions in a secure environment is imperative. Sophisticated attacks on online services have rendered simple password authentication insufficient to protect an organization against unauthorized access to its network and applications. The risks of unauthorized access to your confidential information in today’s internet world are high.

First Security Bank offers a leading strong-authentication service that enables your enterprise to secure online access and transactions to help enable confidence in your security and reduce fraud risk. A fully hosted SaaS solution, our VIP 2FA offers a cost-effective way to give legitimate users access to your business resources and Business Online Banking while thwarting identity thieves and e-fraud cartels.

What is Two-Factor Authentication (2FA)?

Two-factor authentication combines something a user knows, such as a username and passcode, with something he or she possesses, such as a unique six-digit security code (that changes every 30 seconds) generated by a token or a mobile phone.

Credential Options

- Increase Confidence – address your security concerns to increase confidence in conducting business online.

- Reduce Fraud Costs – prevent unauthorized transactions to reduce the occurrence of fraud.

If you would like more information, please contact us. You can contact us via e-mail or use this website to find the First Security Bank nearest you.

Business Loans

Commercial

Read More about Commercial.Small Business

Read More about Small Business.We offer competitive interest rates on commercial loans to help fund all types of businesses. Since all loan decisions are made locally, you will receive a fast decision on your loan application and the security of knowing that when emergencies arise, your loan officer will be just down the street, ready to assist.

- Business Loans

- Construction loans

- Equipment Financing

- Commercial Real Estate

If you would like more information, please contact us. You can contact us via e-mail or use this website to find the First Security Bank nearest you.

Our loan officers are dedicated to helping small businesses meet their financial service’s needs. First Security Bank can be your single destination for personal and business accounts and financing, in assisting you with a variety of tools and services. First Security can help your small business secure the financing you need to start, run, or expand, with local and friendly service.

- Business Loans

- SBA Loans

- Business Lines of Credit

- Business Credit Cards

If you would like more information, please contact us. You can contact us via e-mail or use this website to find the First Security Bank nearest you.

Debit & Credit Cards

Debit Cards

Read More about Debit Cards.Credit Cards

Read More about Credit Cards.Convenient access to your business checking account with a First Security Business Debit Card.

- Make purchases anywhere MastercardTM is accepted

- Multiple cards can be issued for multiple individuals on an account

- Use at over 500,000 ATMs worldwide

- Real-Time Account Balance & Transaction Tracking

Business Debit Card

A First Security Business VISATM offers your business the convenience and purchasing power needed to operate efficiently in today’s fast-paced business world. Transactions wherever VISA is accepted with no interest when your balance is paid in full each statement period.

Features and Benefits

- No Annual Fee

- Competitive Interest Rate

- Balance transfer available upon approval

- Multiple cards available on the same account

- Credit limits can be assigned to each individual card holder

- Consolidated Statements Option Available

- Travel Accident Insurance